Licensed Manufacturing Warehouse LMW is a warehouse license under the provision of section 6565A of the Customs Act 1967 Malaysia. Sales and use tax rates vary from state to state and generally range from 29 to 725 at the state level.

Sale Of Goods The Sale Of Goods Act

CFR Cost and Freight.

. Businesses are expected to file 2 monthly returns as well as an annual return. INLAND REVENUE BOARD OF MALAYSIA DISPOSAL OF PLANT OR MACHINERY PART I - OTHER THAN CONTROLLED SALES Public Ruling No. It is important that the original seller should have rightful ownership of goods if he does have the right to sell goods the subsequent buyer will gata good title.

In that case a car was. The risk of loss of or damage to the goods passes when the goods are on board the vessel and the buyer takes on responsibility for all costs from that moment onwards. National Employers Mutual General Insurance V Jones it was held that for the purposes of the Sale of Goods Act 1979 UK a thief could not be the seller.

72017 Date Of Publication. 12 December 2017 _____ Page 3 of 18 was RM55000. The GST Council has assigned GST rates to different goods and services.

The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers - Any employee as long as his month wages is less than RM200000 and. However sales and use taxes constitute a major revenue source for the 45 states that impose such taxes and the District of Columbia. The purpose of LMW is to give Customs duty exemption to all raw materials components and machinery and equipment used directly in the manufacturing process of approved produce from the first stage of.

The van was licensed for commercial purpose for the transportation of company goods. The seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered. The Employment Act 1955 is the main legislation on labour matters in Malaysia.

Malaysias new Fiscal Responsibility Act may open the path for the reintroduction of the Goods Services Tax GST according to OCBC Treasury Research which opined that should. No provisions exist for a sales tax or value-added tax VAT at the federal level. Under the Goods and Services Tax registered dealers must file their GST returns with details regarding their purchases sales input tax credit and output GST.

Sales Of Goods Act Agreement To Sell Legal Environment Of Busines

Sale Of Goods Act Law446 Topic 4 Sale Of Goods 1 June 2019 Kim Q Is Very Conscious About Her Studocu

11125 Sale Of Goods Act 1930 Sale Of Goods Act 1930 Contract Of Sale Cos Of Goods Is A Contract Whereby The Seller Transfers Or Agree To Transfer Course Hero

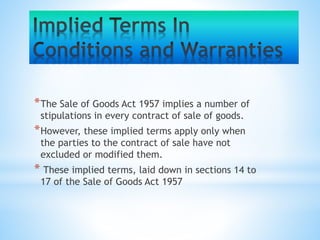

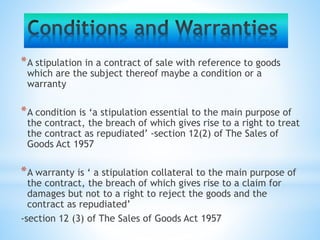

Implied Conditions And Warranties Under The Sale Of Goods Act Ipleaders

Sale Of Goods The Sale Of Goods Act

Sales Of Goods Act Agreement To Sell Legal Environment Of Busines

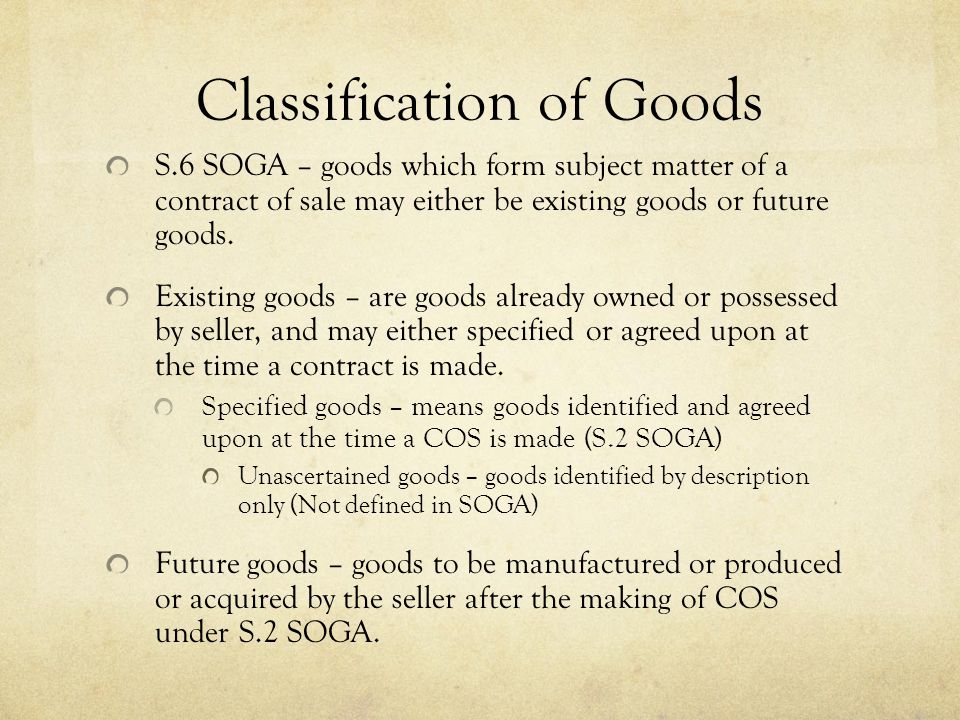

Sale Of Goods Act 1957 Sale Of Goods 1 Laws Of Malaysia Reprint Act 382 Sale Of Goods Act 1957 Studocu

Commercial Law Sale Of Goods Ppt Download

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Sale Of Goods The Sale Of Goods Act

Sale Of Goods The Sale Of Goods Act